BACKGROUND MATERIALS on Lake Maintenance

Illinois Department of Natural Resources summary of dredging options compiled in June 1998.

The Environmental Learning Center Website on Turbidity and Water Clarity

Engineers Watershed Study and Lake Management Recommendation

IDNR Dredging Fact Sheet

Why Dredge/Howe it Improves Water Quality

MATERIALS FROM PAST LAKE MAINTENANCE

PROPOSALS THAT HAVE FAILED TO PASS

THE COMPROMISE PROPOSAL – Mailed 10-19-2018

2018 Lake Maintenance Proposal

To be discussed at an open meeting 7 p.m. Monday, October 29, at Edwardsville Public Safety Building, 333 S. Main Street, Edwardsville, IL 62025

Oct. 29 Board Meeting Q&A –

To get help figuring your assessment or to ask something not answered below just email Manager@DunlapLake.org or call Carolyn Green at 791-1398.

- The Special Assessment is based on the county’s ASSESSED value of your home, NOT THE MARKET VALUE. The assessed value is about 1/3 of the market value.

- Residents can pay the special assessment up front if they want to avoid paying interest or to get their own better interest rate. Jim Taylor, a board member who is a banker, explained the formula for buyouts and stayed after the meeting to help people estimate theirs. Use the contact information in bold above if you want help estimating yours.

- The special assessment amount can change from year to year. It is based on the debt service that has to be paid and the total assessed value of all the homes in the Association. As homes are built or improved, the amount could go down a little. If houses are torn down it could go up a little.

- The maximum rate of .0085 is based on a 6.25% interest rate.

- One of the banks Alan talked to said if a house sells before the 15 years is up the loan must be paid at closing.

- Residents are encouraged to look into getting a home equity line of credit to pay the special assessment up front. Rates will probably be lower, you can choose the bank and negotiate your own terms, you can pay it off at your own speed and home equity loans are usually tax deductible.

- Voting yes on this proposal allows the board to negotiate and take out a loan. If other funding option (like a special service area) is found to be significantly more cost-effective it is possible to present a real comparison of terms and the advantages and disadvantages of the different options to the membership for a vote.

- The money being borrowed and paid up front for the special assessment will be used to create the infrastructure for a silt basin and de-watering facility. The annual assessments will cover the silt removal. It will be pay as we go. It will take longer to dredge the whole lake than in previous plans but it spreads out the payments.

- Engineers have tested the soil on the property at 840 East Lake Drive and believe it will hold approximately 40,000 cubic yards of silt.

- Engineers have tested the soil on the property in the old silt basin across the street, known as commons area E8, and said there is not enough clay, the material there holds too much water. It would not be cost effective to use that property.

- Members present presented several different perspectives on what was fair. Alan explained that this plan was designed as a compromise that took the different preferences into account.

- The silt curtain, berm and the weir across the south end were cut from previous proposals made to drop the price of the current plan. The pay-as-you go model does allow flexibility if those items are found to be needed later.

- Vendors can bid the work using either an excavator or a hydraulic dredge.

- There are around 360 properties in the Association. Each gets 2 votes. It takes 2/3 of those voting to pass this proposal.

ADDITIONAL RESIDENT QUESTIONS

10-23-18 Is “assessed valuation” the taxable value of my home which is 1/3 of the fair market value of the home or the fair market value which is $297,900.

It is the taxable value of your home as identified on the County website or the card that was mailed to you from Madison County. You multiply it times .0085 to get what will be your special assessment amount per year.

10-24-18 . Can I pay special assessment up front – YES

1) Calculate Total Assessed Value After Exemptions for DLHOA properties,

2) Divide Individual DLHOA Property Assessment After Exemptions by Total Assessed Value After Exemptions for DLHOA properties

3) Multiply that percentage by principal loan amount

Lump sum payer basically save the interest payment on the Loan.

The assessed value of each parcel in the DLPOA will need to be updated each year from county records. The special assessment factor will also vary (not to exceed .0085) based on the aggregate assessed value of all the properties and the amount needed to meet debt service.

Taking out a home-equity loan to make a lump sum special assessment payment might be a good option. Lake calculations are based on 6.25 plus a 1.05 coverage ratio while most home-equity loans are lower than that right now.

10-25-18 What is the majority that has to be met for this to pass?

2/3 which is 66.67%

10-29-18

Q – I would like to learn more about the proposal to raise the HOA fees in addition to the 15 year tax increase. I feel the increase is too high to socialize with an increase in taxes.

First, just to be clear, the 15 year special assessment is not a tax increase. It’s a special assessment under the DLPOA Covenants and Restrictions.

The previous proposals to remove silt from the lake were for a $4.5 million project and that was strictly for silt removal. Under that proposal, that entire amount would be financed via a special assessment. Two different proposals for the $4.5 million project were put out for a vote. Each received 61% support. We needed 67%. Since then we have been informed by the Illinois Dept. of Natural Resources (IDNR) that we need to redesign and expand our spillway to handle more water more efficiently. That was after we undertook 3 emergency repairs to the spillway over the last few years. We also need to make changes to the drainage silo to prevent an accidental drainage of the lake. So, it became clear to the board that our needs were more extensive and occurring over a longer term than just removing silt from the lake to improve water quality.

In addition, there has been a division among property owners as to how to pay for these things with some advocating for a special assessment based on assessed value and others advocating for a flat rate. Therefore, in an effort to both handle our long-term needs and to try to bring the assessed value and flat rate people together, we crafted this hybrid proposal with the basic infrastructure needed to remove silt being financed with a temporary, special assessment and on-going silt removal, spillway and drainage silo improvements being funded on a pay-as-you go basis from an increase in the flat-rate annual assessment.

Please believe me, we do not undertake this lightly. All the board members are property owners who will pay the same assessments as everyone else. Maintaining the lake, dam, spillway, etc. is a big and complicated job and it’s not inexpensive. But the alternative–letting all of that continue to deteriorate–is simply not an option if you value your property and still want to live here. –Alan Ortbals

If you sell your house during the 15-year period who is responsible for paying the remainder and how will that be disclosed in real estate transactions?

The proposal is based on terms we have received from the Mutual of Omaha Bank. Under those terms, the bank would be paid any outstanding amount when a property is sold. How that is negotiated between buyer and seller is up to them.

Taking out a home-equity loan and paying a lump sum up front would be a better solution for many residents. Your interest rate will be significantly lower than what we will get as an HOA.

Neighborhood mtg handout – March 2018

Annual Meeting 2017 – PowerPoint Presentation

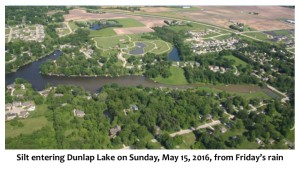

May 18, 2016 PowerPoint Presentation